Coit v. Green

| Coit v. Green | |

|---|---|

| |

| Argued December 9, 1971 Reargued December 8, 1971 Decided December 20, 1971 | |

| Full case name | Coit v. Green |

| Citations | 404 U.S. 997 (more) 92 S. Ct. 564; 30 L. Ed. 2d 550 |

| Case history | |

| Prior | Judgment for plaintiffs, Green v. Connally, 330 F. Supp. 1150 (D.D.C. 1971) |

| Subsequent | Judgment explained in Bob Jones University v. Simon, 416 U.S. 725, 740, n. 11, 94 S.Ct. 2038, 2047, 40 L.Ed.2d 496 (1974), that this affirmance lacks precedential weight because no controversy remained in Green by the time the case reached this Court. |

| Holding | |

| Using federal tax funds to finance private schools for purposes of segregation of students in segregation academies violates the IRS public tax fund rules, as well as the Equal Protection Clause of the Fourteenth Amendment, because discrimination coupled with segregation is inherently unequal. District of Columbia district court affirmed. | |

| Court membership | |

| |

| Case opinion | |

| Majority | Burger, joined by unanimous |

| Laws applied | |

| Section 501(c)(3) of IRC | |

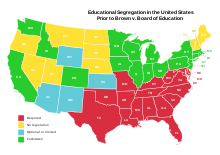

Coit v. Green, 404 U.S. 997 (1971), was a case in which the United States Supreme Court affirmed a decision that a private school which practiced racial discrimination could not be eligible for a tax exemption.[1]

Summary of findings

[edit]In Green v. Connally,[2][3] the court declared that neither IRC 501(c)(3) nor IRC 170 provided for tax-exempt status or deductible contributions to any organization operating a private school that discriminates in admissions on the basis of race. Since this time, if a school has adopted and announced a racially non-discriminatory admissions policy and has not taken any overt action to discriminate in admissions, the Service concludes that the school has a racially non-discriminatory admissions policy. The U.S. Supreme Court, however, specifically did not rule on the hypothetical possibility of a school which discriminated against minorities for religious reasons.

In the interim, the IRS took steps to implement the nondiscrimination requirement including Revenue Ruling 71–447, 1971–2 C.B. 230, Revenue Procedure 72–54, 1972–2 C.B. 834, Revenue Procedure 75–50, 1975–2 C.B. 587, and Revenue Ruling 75–231, 1975–1 C.B. 158. Without comment, the Supreme Court affirmed the judgment of the United States District Court for the District of Columbia at the end of 1971 for the families in this case.

Results

[edit]

A decade later, scores of schools had not changed policies and remained ineligible for tax-exempt status.[4]

See also

[edit]References

[edit]- ^ See Green v. Kennedy, 309 F. Supp. 1127 (D.D.C. 1970), later decision reported sub nom. Green v. Connally, 330 F. Supp. 1150 (D.D.C. 1971), summarily aff'd sub nom (African-Americans "need not be required to plead and show that, in the absence of illegal governmental encouragement, private institutions would not "elect to forgo 'favorable tax treatment, and that this will' result in the availability to complainants of services previously denied"); McGlotten v. Connally, 338 F. Supp. 448 (D.D.C. 1972); Pitts v. Wisconsin Dept. of Revenue, 333 F. Supp. 662 (E.D. Wis.1971) ("As perusal of these reported decisions reveals, the lower courts have not assumed that such allegations and proofs were somehow required by Article Three of the United States Constitution"); Simon v. Eastern Kentucky Welf. Rights. Org., 426 U.S. 26, 64 (1976).

- ^ Green v. Connally, 330 F. Supp. 1150 (D.D.C. 1971), aff'd sub nom, Coit v. Green, 404 U.S. 997 (1971).

- ^ "The Real Origins of the Religious Right". POLITICO Magazine. May 27, 2014.

- ^ TAYLOR Jr, STUART (January 12, 1982). "EX-TAX OFFICIALS ASSAIL SHIFT ON SCHOOL EXEMPTION STATUS". The New York Times. ISSN 0362-4331. Retrieved November 8, 2017.

- Doe and Rabago v. Kamehameha Schools/Bernice Pauahi Bishop Estate, et al. (2007).

- IRS (1982). Update on Private Schools.

- Goluboff, R. L. (2000). "The Thirteenth Amendment and the Lost Origins of Civil Rights." Duke Law Journal, 50 Paper was presented at the 2000 Annual Meeting of the American Society for Legal History. p. 1609.